Ebay stock research rationale and Amazon comparison

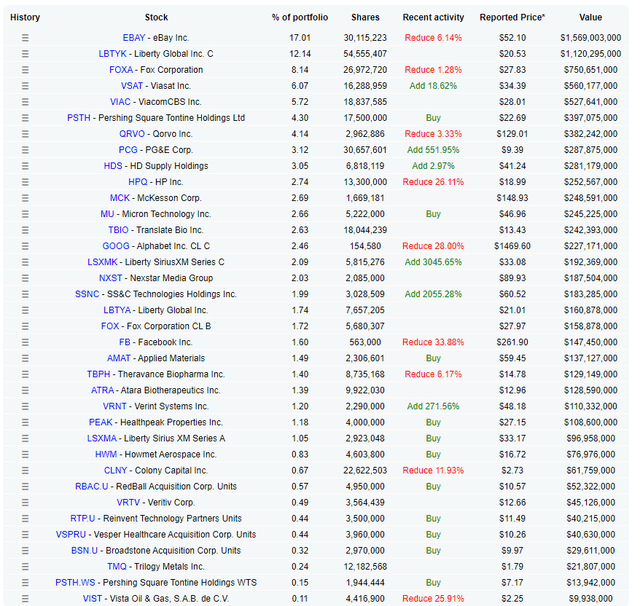

Ebay is Seth Klarman’s largest holding within the Baupost Group. As I regard Klarman as one of the best value investors out there, it is always good to take a look at his positions.

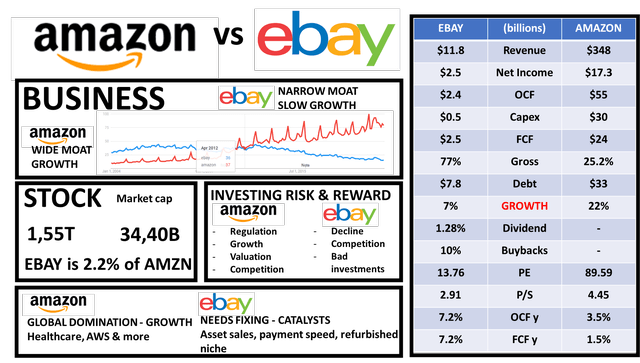

Further, it is always good to compare investments in order to best understand the risks and rewards of a specific investment. I’ve decided to compare Ebay with Amazon due to their competitive environment and because it also gives an excellent perspective on growth and value investing.

Here is the Amazon vs Ebay video version, article continues below.

Ebay and Amazon stock price analysis

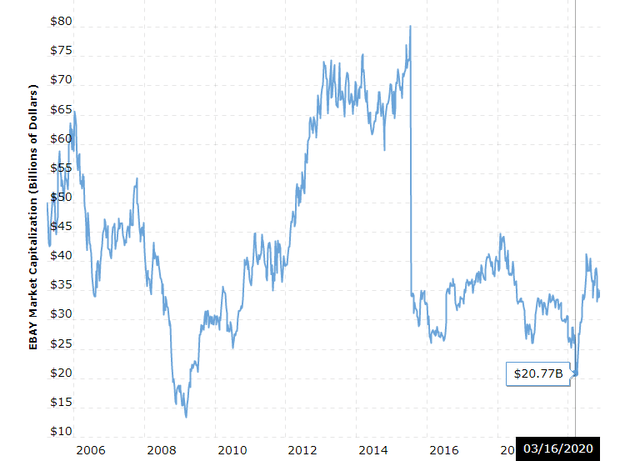

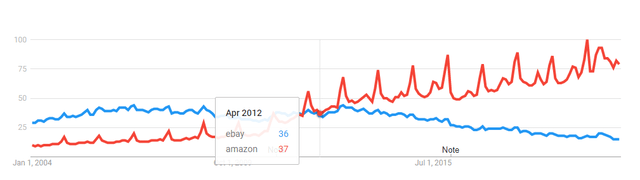

Despite lagging on all fronts compared to Amazon, Ebay’s stock did really well over the last decade and also benefited from the Covid-19 intensification of online purchasing.

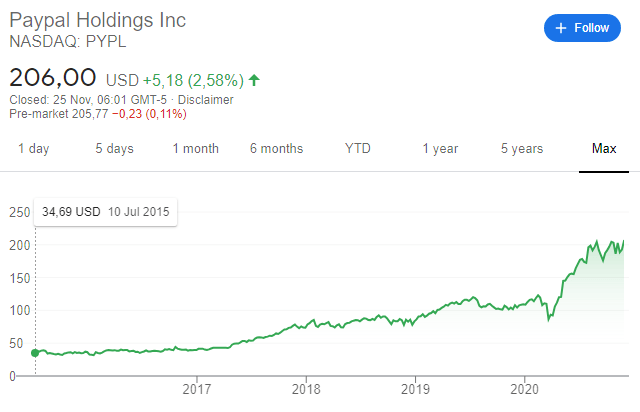

At first sight, Ebay stock didn’t perform as well as AMZN did, but we must not forget the PayPal spin-off in 2015.

Ebay’s market capitalization didn’t change much since, but PayPal’s performance rewarded Ebay shareholders almost equally to what Amazon did for its shareholders.

Excluding PayPal, Amazon did much better.

So, despite Ebay being a declining business, shareholders have been similarly rewarded in the past. However, Ebay is still in a negative trend which is significant for future investment returns while Amazon’s growth is strong and steady.

Despite the declining business, Ebay still managed to reward shareholders as it turned into a value investment. It often happens that way; the stock suffers when the business doesn’t meet exuberant growth expectations, the company needs to replace its growth-oriented shareholders with more value-oriented ones, which takes time, but at some point, the cash flows, revenues, business, and all offer a margin of safety which make it a low risk and high reward investment.

Amazon and Ebay stock investing risks

The two businesses represent two totally different investing worlds. Ebay offers cash flows that are turned into strong buybacks and a dividend while Amazon is still focused on growth and global domination.

Let’s look at the investing situations individually.

Ebay stock investing risk

When it comes to investing risks, the key risks with Ebay should be related to the capacity the company will have to keep things stable. If Ebay manages to slowly grow revenues and create $2 billion in free cash flows per year, that will be the main valuation reference for the market.

If they manage to grow and push free cash flows to $3 billion and higher, that will push the market capitalization higher too but if cash flows start declining, the same fate will hit the stock.

However, the number of active buyers with Ebay is strong and it should even offer growth opportunities.

I think the free cash flows and business stability were the margin of safety Seth Klarman looks for before buying, especially in Q4 2018 when he started buying the current position. (Klarman bought EBAY first in 2014, sold in 2015, probably just a PayPal spin-off catalyst play). $2.5 billion of cash flows, on a stable user base alongside asset sales, provides safety. Consequently, when as a value investor you have limited downside, all that is left is an upside.

But, Ebay’s stock is almost 100% higher than where it was in Q4 2018 when Klarman started buying.

As Klarman himself states in his book Margin of Safety; a higher stock price increases the risk and lowers the return. When Klarman started buying, the free cash flow yield was in the low teens while now we are looking at a free cash flow yield of 7%. In line with Klarman, I would say the stock is riskier now and you have to see how the 7% free cash flow yield and the business fit your portfolio. We’ll discuss more in the investment conclusion in a bit.

Amazon stock investing risks

When it comes to Amazon, it is all about the growth rate and whether the company will keep managing to meet high investors’ expectations. We could say that what is currently priced into the $1.55 trillion market capitalization is a forward growth rate of around 22% per year for longer. The price to earnings ratio is at 89, which is high but I would focus on possible free cash flows, not net income.

With operating cash flows of $55 billion, high capital expenditures of $30 billion, the free cash flows left are $24 billion. But, let’s assume at some point Amazon will manage to just invest $15 billion for sustaining capital expenditures which would leave $40 billion in free cash flows per year.

If the company keeps growing at 22% while keeping profit ratios equal for the next 7 years, the $40 billion free cash flows could easily quadruple to $160 billion. This would give it a 2028 free cash flow yield of 10% based on the current market capitalization. If valuations remain equal to current ones, which I think is unlikely because of natural forces, market size, competition, and other various possible impacts like regulation, then the return for investors will be in line with the growth.

If Amazon manages to do better than expected, we can expect a better stock price performance, if not, then the delta of the delta declines, and the market capitalization can quickly evaporate. I have explained the delta of the delta tool for analysing growth stocks within my Visa growth stock example.

If Amazon’s growth declines to 15%, which is still amazing for a company of this size, free cash flows in 2028 might not be sufficient to justify the current market capitalization, but that mostly depends on what will be the expectations for growth beyond 2028.

Ebay and Amazon stock investment conclusion

Ebay and Amazon operate in the same field but the investment theses are practically opposite. Ebay is, or better to say was, a value investment offering a 10% and higher free cash flow yield in 2019 while Amazon is a pure growth stock.

I would not dare to say one is better than the other, I would say it is more about what you wish to own and what kind of investor you are.

Amazon stock investment conclusion

Owning Amazon is easy, the stock keeps going up, the company continues to expand into new sectors leveraging on its scale and market position. It seems nothing can stop it. As long as Amazon keeps growing fast, the stock price will likely follow. So, nothing wrong with owning Amazon as a growth, global exposure, business strength, and proven concept portfolio position.

However, as a value investor, I personally strive for both a margin of safety and growth. Amazon offers high growth but has no margin of safety. If due to its scale the growth slows down to 10%, or it becomes less profitable to grow, free cash flows in 2028 would be at $85 billion for a 2028 price to cash flow of around 20 which is ok but that implies no return for 7 years which isn’t a great margin of safety. Albeit, unlikely Amazon will grow at just 10% over the next 7 years given the current growth rates.

At current levels, with a price to adjusted free cash flows ($40 billion) of 38.5, Amazon is a fairly priced growth stock. Even if the company grows just 15% over the next 7 years, free cash flows in 2028 should be at $122 billion that with a price to cash flow of 20 could result in a market capitalization of $2.5 trillion giving a 6 to 7% yearly return. Not bad from a conservative perspective.

If they keep growing at 22% and the valuation remains equal, then 22% per year is the expected return. In case of faster growth, expect even higher returns.

Ebay stock investment conclusion

On the other hand, Ebay offers growth of around 7% as they focus on smaller business niches but the stock price has already increased and consequently, the risks increased too. A free cash flow yield of 7% isn’t really stellar but the 183 million active buyers definitely provide some kind of safety margin.

The cash flow return is around 7%, there is still $700 million to be spent on buybacks and with the asset sales it is likely buybacks will continue and debt will be reduced. As long as the company can keep growing, cash flows should remain stable and returns in line with the cash flow yield and growth.

In a worst-case scenario, Ebay’s free cash flows could start declining, but that is unlikely as there is still the positive tailwind of e-commerce growth. I would say the biggest risk is something disrupting Ebay’s current business stability.

If the company can find a way to grow, then we have to add a growth rate to the cash flow yield. That would already create excellent investment returns as the growth of 7% added on top of the 7% free cash flow yield quickly grows to a potential return of 14% per year. Perhaps the best way for a good investment return is a takeover by some fund focused on cash flows. With a 7% free cash flow yield, Ebay is attractive to anyone who can borrow with lower costs.

I would say both Ebay and Amazon are stocks to watch and to buy when the key fundamentals fit your required levels compared to other investment opportunities you have.

If you wish to check what I do, what are my best investment ideas that come out of the intensive research process of which the above is just a small example, please check my Stock Market Research Platform.

The post EBAY vs. AMAZON Stock – Both Good appeared first on Sven Carlin.